The collections industry is evolving quickly. Traditional phone calls and letters, once the backbone of recovery strategies, are no longer enough to reach today’s consumers. At Optio Solutions, we see every day how financial institutions and agencies are adapting to meet consumer expectations, improve recovery rates, and maintain compliance in a more complex environment.

Empty head

Why Change Is Necessary

Consumer behavior has shifted. People now expect the same convenience from debt resolution that they get from online retail, healthcare portals, and digital banking. At the same time, regulatory scrutiny has intensified and reputational risk is higher than ever. Relying on a “call only” approach not only limits engagement but also risks alienating customers and members.

The pressure is clear. Federal and state regulators are watching the industry closely, and consumer complaints remain a top driver of enforcement actions. A single misstep can put both agencies and their financial institution partners at risk. This reality underscores the importance of adopting modern, compliant strategies that prioritize consumer respect while still driving results.

What Omni-Channel Looks Like in Practice Empty heading

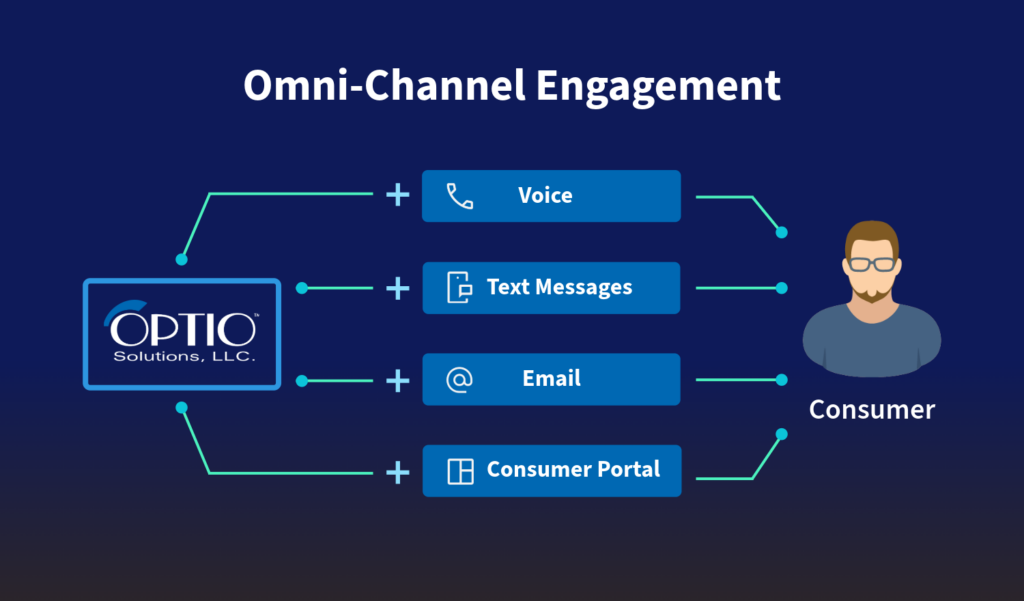

Omni-channel engagement means integrating voice, text, email, and digital self-service in a coordinated, compliant strategy. Each channel has its role:

- Voice is essential for high-value conversations and negotiation.

- Text and email provide fast, convenient reminders and updates.

- Digital self-service portals empower consumers to resolve accounts on their own terms, 24/7.

When combined, these tools increase right-party contacts, shorten resolution timelines, and help preserve positive relationships.

Compliance Comes First

An omni-channel strategy must be designed with compliance in mind. Regulations such as the FDCPA, CFPB rules, and state licensing requirements define how and when agencies can engage. At Optio Solutions, we balance consumer protection with effective recovery, giving our clients confidence that their outreach strategies are both efficient and respectful.

Looking Ahead

Collections is no longer just about recovering past-due balances. It is about building trust and sustaining relationships while delivering results. Agencies and lenders that embrace omni-channel engagement, supported by compliance and data-driven processes, will be positioned to achieve stronger outcomes and protect their brand reputation in the years ahead.

Ready to Learn More?

Optio Solutions partners with financial institutions, credit unions, and businesses nationwide to deliver results through respectful, compliant engagement strategies.

Contact us today to learn how we can help your organization strengthen recoveries while protecting your customer relationships.